Will shares help me buy a home faster?

Many Australians dream of owning their own home but face the intimidating obstacle of accumulating a house deposit.

The median dwelling value in Australia was $785,556 as of 31 May 2024, according to CoreLogic. This means a first-home buyer would need to save at least $157,111 for a 20% deposit - and that doesn't take into account all the extra costs associated with buying a home.

The challenge of home ownership has only been amplified by the recent spate of interest rate hikes and a buoyant property market that seemingly only goes in one direction (up!).

Let's look at some of the options first-home buyers can use to boost their deposit and begin their climb up the property ladder.

Cash accounts

The simplest strategy for building a house deposit is to park funds in a dedicated savings or high-interest bank account. This provides a convenient and safe way to accumulate savings.

In recent years, the returns haven't been that flash. But with the cash rate now at 4.35%, several banks are offering compelling interest rates to win over your hard-earned savings. And these days it's easier to get a great rate without the need to jump through hoops. First-home buyers should note that the deposit rates aren't locked in and can therefore fluctuate over time.

To eliminate the return uncertainty, you could opt for a term deposit. This is similar to a bank account except the interest rate is locked in for a given period, usually between one to five years. While it's unlikely you'll need to break the term deposit, keep in mind early access can result in a fee or interest adjustment.

Government schemes

There are also government grants and initiatives that can help you get your foot on the property ladder.

One option is the First Home Super Saver scheme (FHSS) which allows home buyers to accumulate savings within superannuation, where earnings are taxed at 15% instead of the personal income tax rate, which can be up to 45%. Importantly, only eligible voluntary contributions up to $50,000 can be withdrawn. Employer contributions made under the superannuation guarantee are not eligible.

There's also the First Home Guarantee (FHG) scheme which lets home buyers on low and middle incomes purchase a home with as little as a 5% deposit. Housing Australia will guarantee the lender up to 15% of the property value, however spots are limited.

Shares

Budding home buyers willing to take on more risk may consider shares. When we take a long-term horizon, shares have the highest return profile of any investment class.

Australian shares have returned 9.0% per year through a combination of dividends and capital growth over the past two decades, according to the 2023 Vanguard Index Chart. Cash (similar to a high-interest saving account) has returned just 3.5% per year over the same period.

The difference in returns between the two might not seem that big in a given year. But the power of compounding means first-home buyers who invest in shares can purchase a home much sooner.

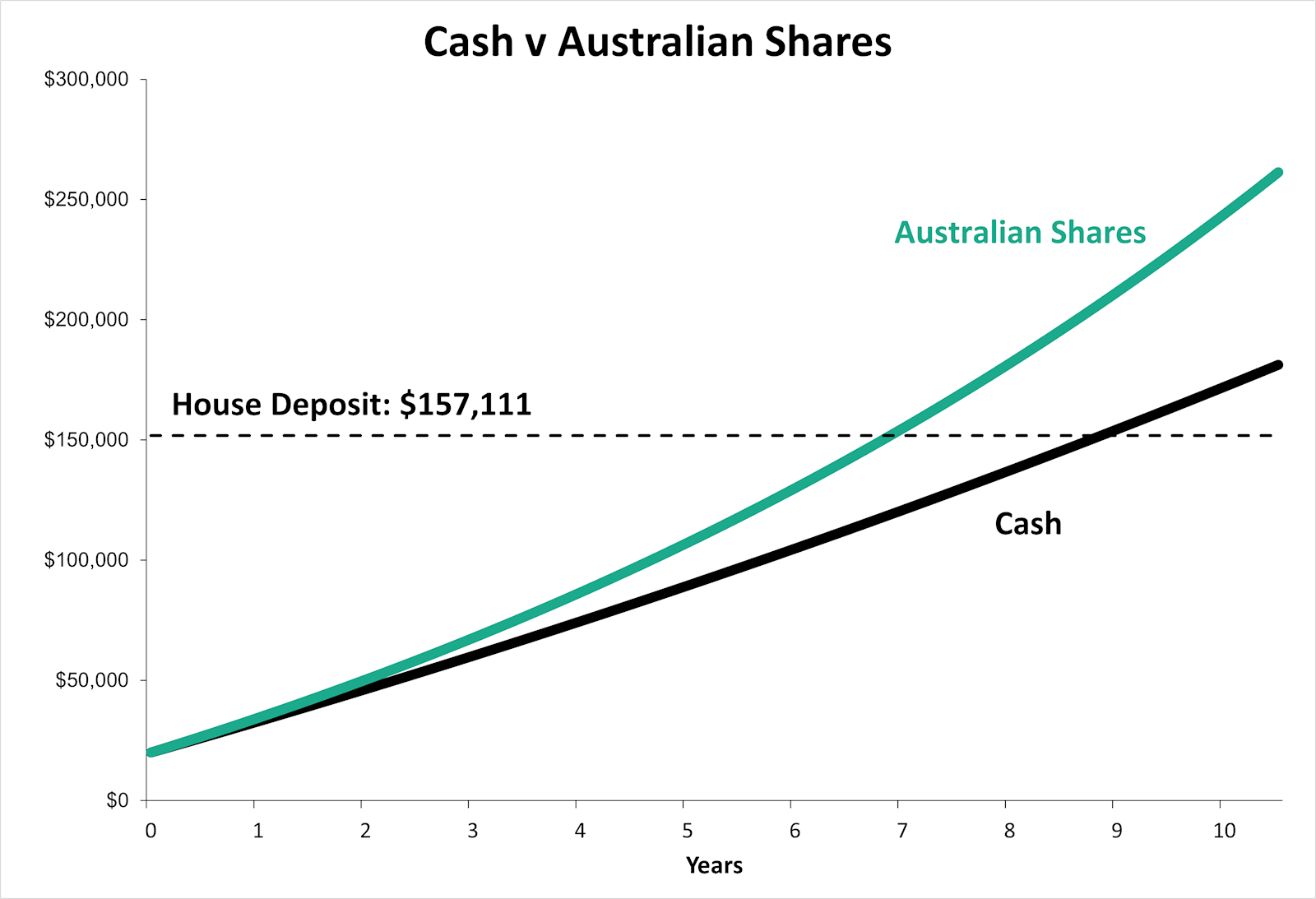

We crunched the numbers based on an initial investment of $20,000 followed by contributions of $1,000 a month and found that investing in shares means a first home buyer reaches their house deposit in seven years, compared to nine years when investing only in cash. Put another way, investing in shares reduces the time to reach the elusive deposit by two years.

Note: Assumes initial savings of $20,000 with monthly contributions of $1,000.

By the time someone who invested in cash reached roughly $157,000, another home buyer who invested in shares is forecasted to have close to $217,000. To keep things simple, this example hasn't taken tax into consideration.

The downside of investing directly in shares is that the returns are not guaranteed. Individual companies are volatile and returns in the short and medium term can gyrate significantly.

Moreover, deciding what companies to buy is an arduous task and can leave home buyers under-diversified. Enlisting the help of a fund manager can solve this problem, but also means you'll be hit with fees.

ETFs

Another way to achieve diversification is through the use of exchange-traded funds (ETFs).

An ETF holds a basket of securities that tracks a specific index. For example, the iShares Core S&P/ASX 200 ETF (ASX:IOZ) tracks the largest 200 companies on the Australian Securities Exchange, which includes the likes of Commonwealth Bank, Woolworths and BHP.

This takes the guesswork out of determining which shares to buy and smoothens out the volatility associated with individual businesses. Please note, however, ETFs are not suitable for home buyers with short time horizons. Investors also need to consider brokerage costs and tax implications.

Home buyers who need the deposit readily or are averse to shares can opt for ETFs that own a portfolio of bonds or cash securities. These are less risky and offer more certain, albeit lower, returns.

The overarching takeaway is that ETFs can provide low-cost diversified exposure and there are no penalties for withdrawing.

Key takeaways

Ultimately the decision to invest in cash, term deposits, fixed income or shares will depend on your time horizon and risk tolerance. No one option is suitable for everyone, and you may even adopt a combination of investments to achieve your objectives.

Regardless of the strategy chosen, the key is to be patient and let the power of compounding build the deposit over time.