ETF Snapshot: 4 out of 10 Australian investors now have international holdings

Five new Exchange Traded Products (ETP) were released in November, all of them ‘thematic in nature including Australia’s first ever ‘crypto’ Exchange Trade Fund (ETF) – Betashares’ Crypto Innovators ETF.

Over the month of November total funds flows into Australian listed ETPs was up $1.9 billion.

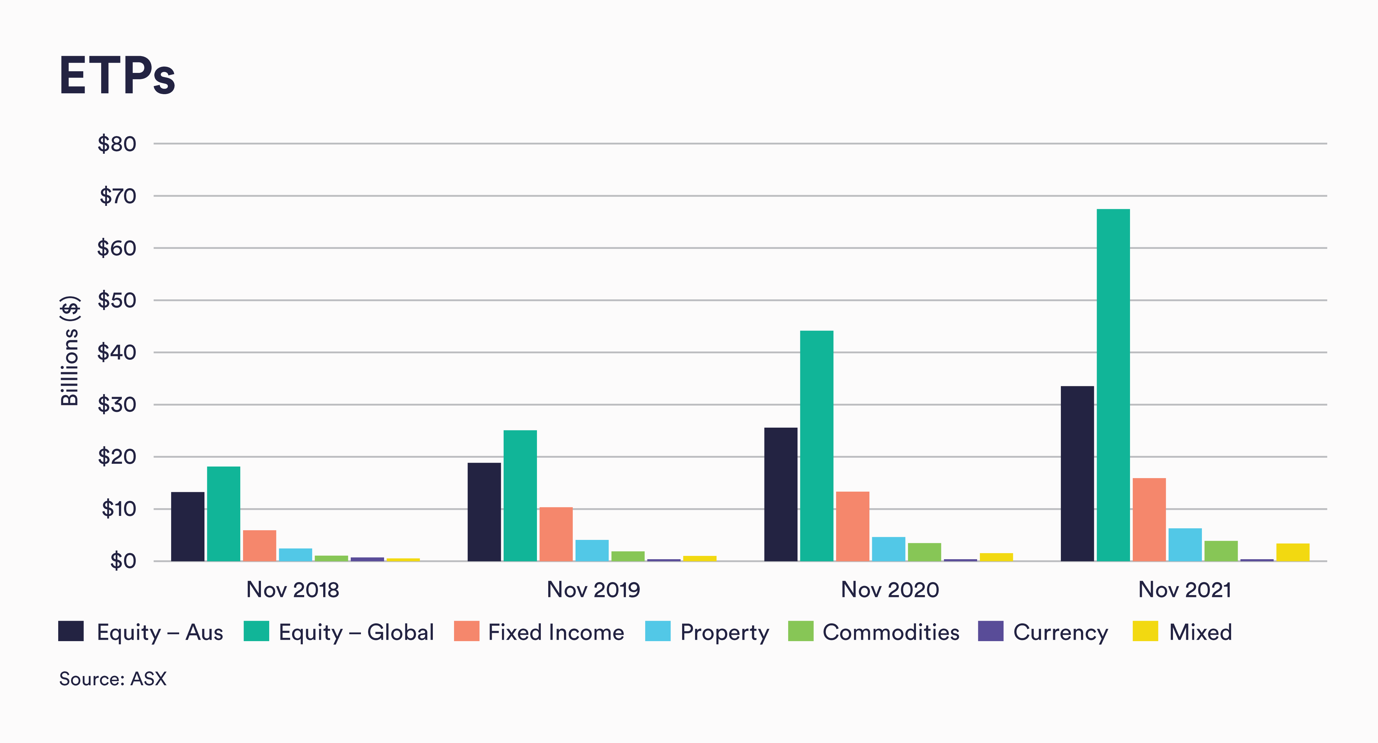

Month on month Australian equity ETPs grew 1.8 per cent to $33.5 billion meaning year on year Australian Equity ETPs have increased 31.8 per cent since November 2020.

The real story in ETPs is the growth of ‘Global’ equities

In the month of November Global Equity ETPs grew 6.4 per cent to $63.4 billion meaning year on year the group has increased by 52.2 per cent since November 2020. InvestSMART saw similar growth in demand for its International Portfolio up 8.2% over the same period.

As this chart shows the growth in Australians investing in Global Equities has rapidly accelerated in the past 4 years outstripping all other asset classes.

This is an exciting trend as it shows Australians are increasing their exposure to international markets something they have not done in the past. With the recent advent of robo advisers like InvestSMART, investing apps and international funds listed on the ASX, gaining access to this asset class in much easier than its ever been before.

Breaking down the Internationals ETPs on a geographical basis and the flow of funds was out of the underperforming China and Asian funds and into the US and Europe funds. A trend that has been present for the past 2 months and is expected to continue.

.png)

According to a recent ASX survey 4 out of every 10 Australian investors today has some form of international holdings, well up on 10 years ago when it was only 2 in 10 investors.

The same survey found 45 per cent of ‘next gen’ investors (those under 55 years) are planning to invest in ETFs over the next 12 months suggesting these trends will continue.According to a recent ASX survey 4 out of every 10 Australian investors today has some form of international holdings, well up on 10 years ago when it was only 2 in 10 investors.

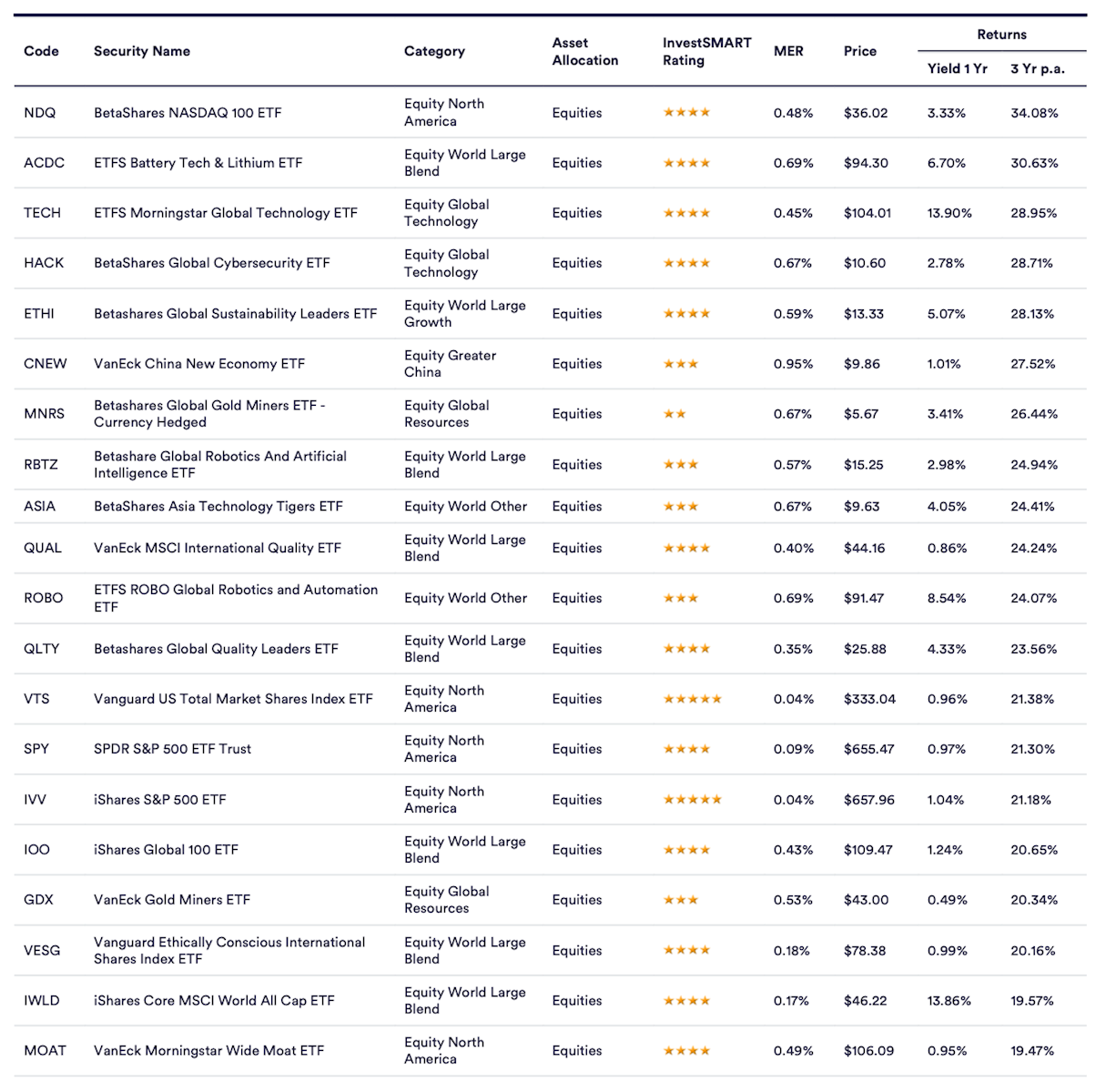

Top 20 ETF’s table below.