Bitcoin ETFs and the weight of money

Here’s a not so bold prediction: in 24 months Bitcoin will sit alongside private equity, water rights and other alternative assets in Australians' retirement accounts. This won’t be due to it being a sensible investment, but from the weight of money from individuals who through social and mainstream media have been fed article after article over the years about crypto.

Each year the ASX conducts an investor survey and for the first time the 2023 included crypto currency. The survey showed that 29% of people intending to invest were interested in cryptocurrencies. With increased media coverage and actual accessibility through a medium people understand, that 29% will grow.

Currently you can buy crypto via an online exchange, yet with the SEC in the US approving the listing of the first bitcoin spot ETFs, Australian customers of domestic brokers who offer international trading will likely be able to buy into the US listed ETFs soon. The ASX will almost certainly follow suit with approval of these products, which will be the turning point for 'crypto sector' in this country.

Do we need another cryptocurrency entry point?

There are already a number of ETF issuers lined up to list, first mover advantage plus the lower cost providers will be a huge advantage if they’re wanting to piggyback off the news flow.

These ETFs will be marketed as an easy and safe entry point into crypto. The truth is, those who already wanted crypto and were slightly tech savvy already have it, with account openings far more streamlined and advanced than any standard broker. Crypto exchanges didn’t need to build off legacy technology like the banks do.

Just like many thematic ETFs before them, the new Bitcoin ETFs are cashing in on the wave of strong past recent performance. Thematic ETFs tend to list at the opportune time to attract hot money. Investing thematically can be dangerous for retail investors, particularly in a volatile asset class like crypto currency. There's often a strong sense of FOMO with these products, but they can quickly fall out of favour if the underlying asset class underperforms. Investors move on to the next big thing, often losing money in the process.

Open the floodgate for fees

But back to our prediction above. Why do we say this? The weight of money and the potential fees to be generated from that money will prove unstoppable. First will come the ETF issuers. In the US on its first day of trading the iShares Bitcoin Trust ETF received $4.6b on inflows. The ETFs management fee is 0.25%pa. That’s $11.5m per annum just from day one.

Next in line is the ASX, receiving listing fees from these ETFs. Then come the brokers facilitating the demand and clipping the ticket on each transaction. A number of local brokers including Commsec have already said it would allow people with international trading accounts to access the US listed ETFs.

Advisors are the new untapped sector

In Australia the real weight of money will come from the advised sector. Research firm Rainmaker estimates $1.6 trillion sits with advisors. Currently, the crypto landscape is dominated by smaller balanced investments with a median balance of $5K. This makes sense as younger people made up 84% of crypto investors surveyed by the ASX. ETFs and advisors hold the key to unlocking a hoard of potential speculators (with much deeper pockets), like when they open the gates at Flemington on Cup Day.

Those advisors rely on investment committees which have lists of approved investments that advisors can invest clients' money into. The investments on those lists are approved by third parties known as ratings agencies. These agencies charge a fee to fund managers and product providers to review and rate their funds in the hope that they will end up on platforms and on the approved product lists of advisors.

What drives that is demand. If enough people go to their advisors and say they want to invest in Bitcoin then the demand will go up to the investment committees and then to the research houses. Advisors won’t necessarily agree with or push for crypto exposure in a clients’ portfolios but they might not have a choice. Advisors need to manage the balance between managing the client and managing the client's portfolio. The two are not always the same.

Research houses will slot these ETFs into the alternative asset class category with disclaimers but inevitably with a rating that allows those downstream to use them as they need. The Bitcoin ETF will be looked at in comparison to alternative investments in the same category, therefore if you’re investing in crypto this is the preferred exposure.

So, we now have the ETF issuers, the ASX, brokers, advisors and the ratings houses all making a fee. This has been a new feeding frenzy a long time in the making.

The potential to set loose another type of frenzy

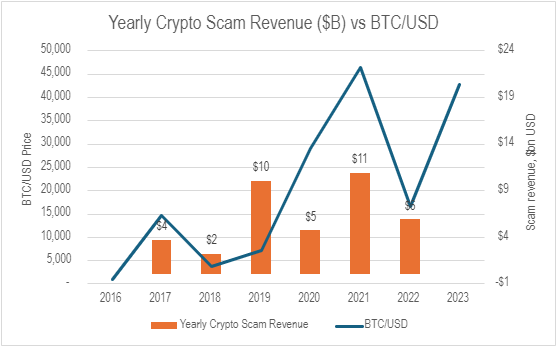

With the legitimacy of ASX listing we fear a rise in crypto related scams. With the increase in attention the area gets there is an increase in scams. Below you can see the number of crypto related scams tracked against the price of Bitcoin. As awareness grows the peaks in revenue also grow. 2024 could be a bumper year.

Source: Chainalysis & IRESS

Who will make money?

To us, Bitcoin does not fit the mould for a traditional investment portfolio. It does not produce income nor is it backed by real assets.

When you buy into an ASX 200 ETF you are buying an ownership stake in 200 Australian companies. You’re buying a stake in Woolworths and get paid dividends for the groceries it sells, cash from Telstra with every phone plan sold.

Allocating a small amount to bitcoin is fine, in our view investors should only consider it as a small part of a well-diversified portfolio. It should be considered highly speculative and treated as such. Investors should be comfortable with the possibility of losing the entire amount invested.

With speculative assets such as Bitcoin money is made from someone paying a higher price for that asset than you did. But now, we foresee plenty of people generating income from Bitcoin (legally and illegally), just not the investor.