- Search

- Top FAQs

-

I'm considering investing with InvestSMART

-

I'm Invested in a PMA

- Retirement FAQ

-

InvestSMART Fundlater

-

Bootcamp

-

Referral Program

-

Investment Process & Philosophy

- Portfolio Manager

-

Managing My Account Details

Can't find your answer? Use our chat function on the bottom right and one of our team will help you out.

Portfolio Manager

What is the Portfolio Manager tool?

InvestSMART's free Portfolio Manager provides a simple way to monitor your investments in one easy place.

-

Save time and money. Track your shares across the ASX and international stock exchanges, ETFs, LICs, plus over 8,000 managed investments, including superannuation and pension funds. Set up email alerts and share them with your accountant or financial adviser.

-

Monitor your performance with 20-minute delayed pricing and optimise your portfolio with our HealthCheck™ feature.

-

Automatically track your dividends and holdings with free data feeds from the ASX and insights from our team of analysts & wealth advisors.

Keep a healthy portfolio.

-

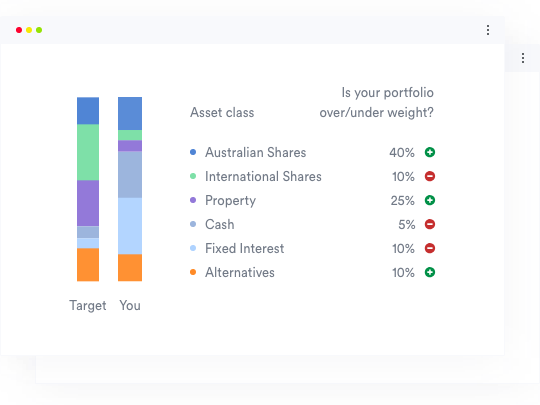

Investment Goals Choose an appropriate target asset allocation according to the risk and returns you may likely expect over your investment time horizon.

-

Overweight or Underweight HealthCheck™ dynamically values your portfolio and compares it against your target asset allocation to show where you can optimise your investments.

-

Simulate asset allocation changes. Play around with changing your investment mix to see how it improves your portfolio.

Safe and Secure

We keep up-to-date with security best practices to ensure your financial

data is safe and secure.

Thousands trust us

Thousands of Australians trust us to monitor over $20 billion of their assets every day

Strong Encryption

Our website uses bank-level, 256-bit SSL encryption and other state-of-the-art solutions to protect your information.

Your information is safe.

We don't share your financial information with any third parties.

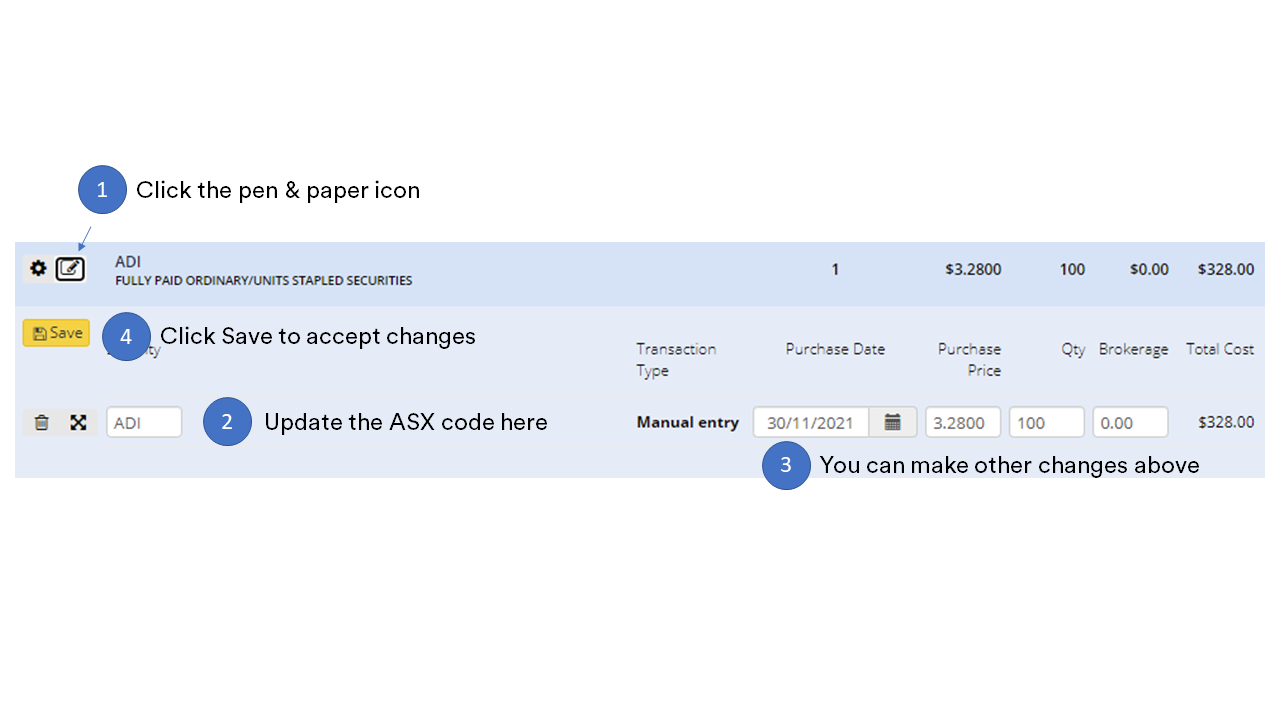

Changing or updating ASX ticker code symbol

In the Portfolio Manager, you can view and update information relating to your ASX holdings.

This is handy if you need to correct the holding or update it if there was an ASX ticker code change.

-

Find the ASX holding you would like to change and click the pen and paper icon.

-

You can change the ASX code

-

Review and update any other information if needed

-

Remember to save your changes

What is a portfolio?

A portfolio is a collection of investments that are owned by individuals and corporations. Some types of investments include shares, property and fixed interest. Our portfolio manager allows you to have multiple portfolios.

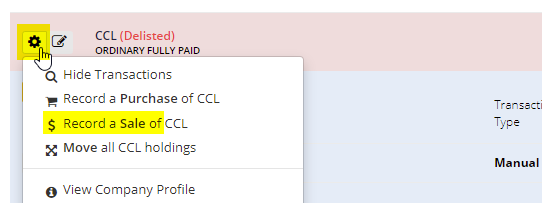

Share or stock sold or delisted in Portfolio Manager

How to enter a sell or delist in the Portfolio Manager to close off a position.

The Portfolio Manager only tracks the daily share prices.

If you sell, buy, or your share is delisted, you'll need to manually update that position. It won't automatically update this for you.

How?

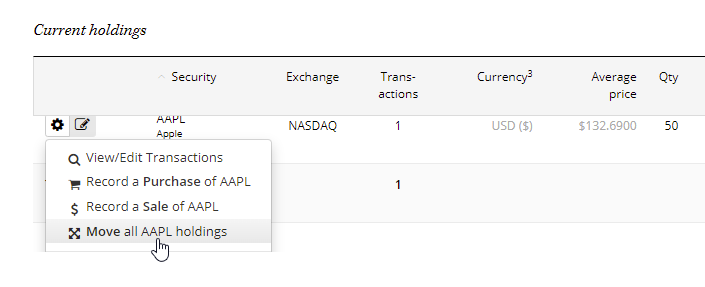

Go to your current holdings and find the stock.

Click the cog/gear at the left, then choose Record a Sale of ...

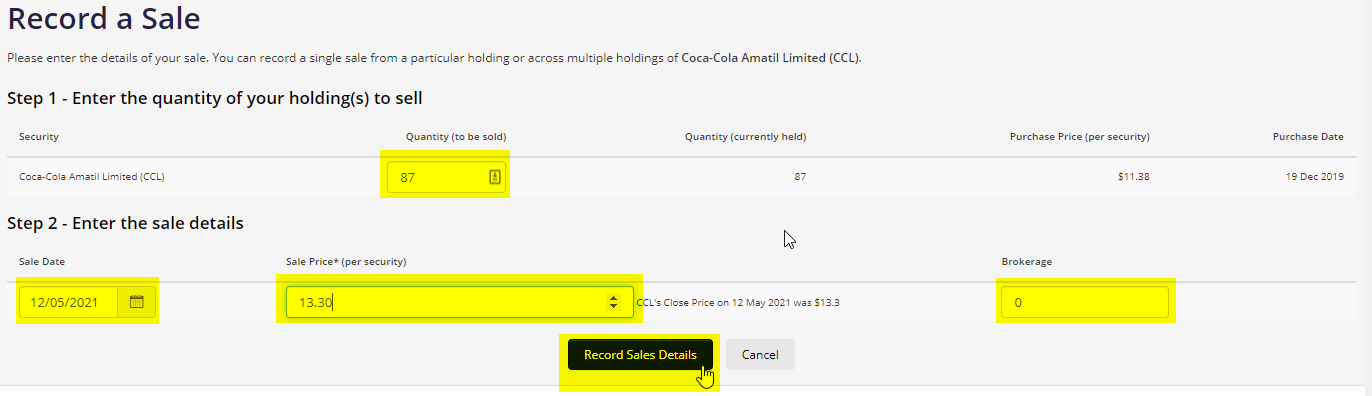

At the top, the Record a Sale box appears.

Enter the quantity sold.

Enter the sale date, the sale price, and any brokerage.

You may need to consult your share broker or other documentation.

Click 'Record Sales Details'

Stock split or consolidation for shares in the Portfolio Manager

Sometimes companies will announce a stock split or stock consolidation. They might do this to make each share more affordable for the retail investor. Consolidations are most commonly used when a company's share price has fallen, and it wants to prevent a delisting of its shares or attract more investors.

Remember that the Portfolio Manager won't reflect changes like this automatically. It will simply track the share price and reflect it against the information you've entered.

Example:

Let's use the example of iShares Core S&P 500 ETF (ASX:IVV) when the stock had a 15-for-1 stock split. This meant for every 1 share of IVV you held (around $595 before the split) you received an additional 14 IVV shares (roughly $39 a share). This means that the one share was split into fifteen:

$595/15 = $39 per share

It's important to note that the overall value of your holding doesn't change.

How to make this change in the Portfolio Manager

First, it is recommended to use the information provided by your share broker or share registry for the most accurate details.

You can see below at (1) that my original purchase price per share was $357.35. At (2), my shares had the quantity of 5. The value of my purchase is at (3). The price today (4) is $38.87 a share. My dividends received so far are at (6). Because I've not reflected the stock split, my Profit/Loss at (7) is now incorrect.

This is easily fixed.

I've checked my share broker statement or communication, and it shows that on 6 December 2022, the stock was split, and I received 14 additional IVV shares. I now have 75 IVV because of the 15-for-1 stock split (5 x 15 = 75).

In the Portfolio Manager tool, I need to close my original position but not register a capital profit or loss. I have received dividends in this example, so I want to ensure they're recorded.

I can record a sale in the Portfolio Manager and use the original purchase price and quantity.

When recording the sale, I'll enter 5 as the quantity (1), the sale date is the date the stock split occurred (2), the original purchase price as the Sale Price (3), and then Record the sales details at (4).

At the bottom of my list, I'll have a Record of Sales area that shows my sales.

My sale price is shown at (1), my buy price of this sale is at (2), my profit/loss capital is $0 at (3), and my dividends have been recorded as $152.28 at (4). Perfect!

Now, I need to enter the holding back into the Portfolio Manager with the new details. At the top of the list, go to Record a Purchase (1).

l'll enter the same ticker/stock/ETF code at (1), and then the date of the stock split at (2). At (3) my new issue price is $23.8233 ($357.35/15). My new quantity is at (4), which is 75 (5 x 15). My total cost is shown at (5), and it's the same as my original cost, along with the sale proceeds which I did earlier. Don't forget to click save (6).

Voila! My position now reflects my actual holding. (1) shows the new purchase price because of the split, and (2) has my new quantity. (4) shows today's share/unit price, and (5) accurately reflects my running capital gain/loss. My dividends have been taken and are now recorded in the sale area, so this will show $0 until I receive a new dividend.

Stock Consolidation

For a stock consolidation, the opposite applies. You'll multiply the purchase price and divide the share quantity.

Multiple Portfolios in Portfolio Manager

Q. Can I put more than one separate portfolio in Portfolio Manager?

Yes

You can have multiple portfolios in the Portfolio Manager with different goals to match each one.

To add a new portfolio, open the Portfolio Manager by clicking 'MyPortfolio' from the black bar at the very top of the page.

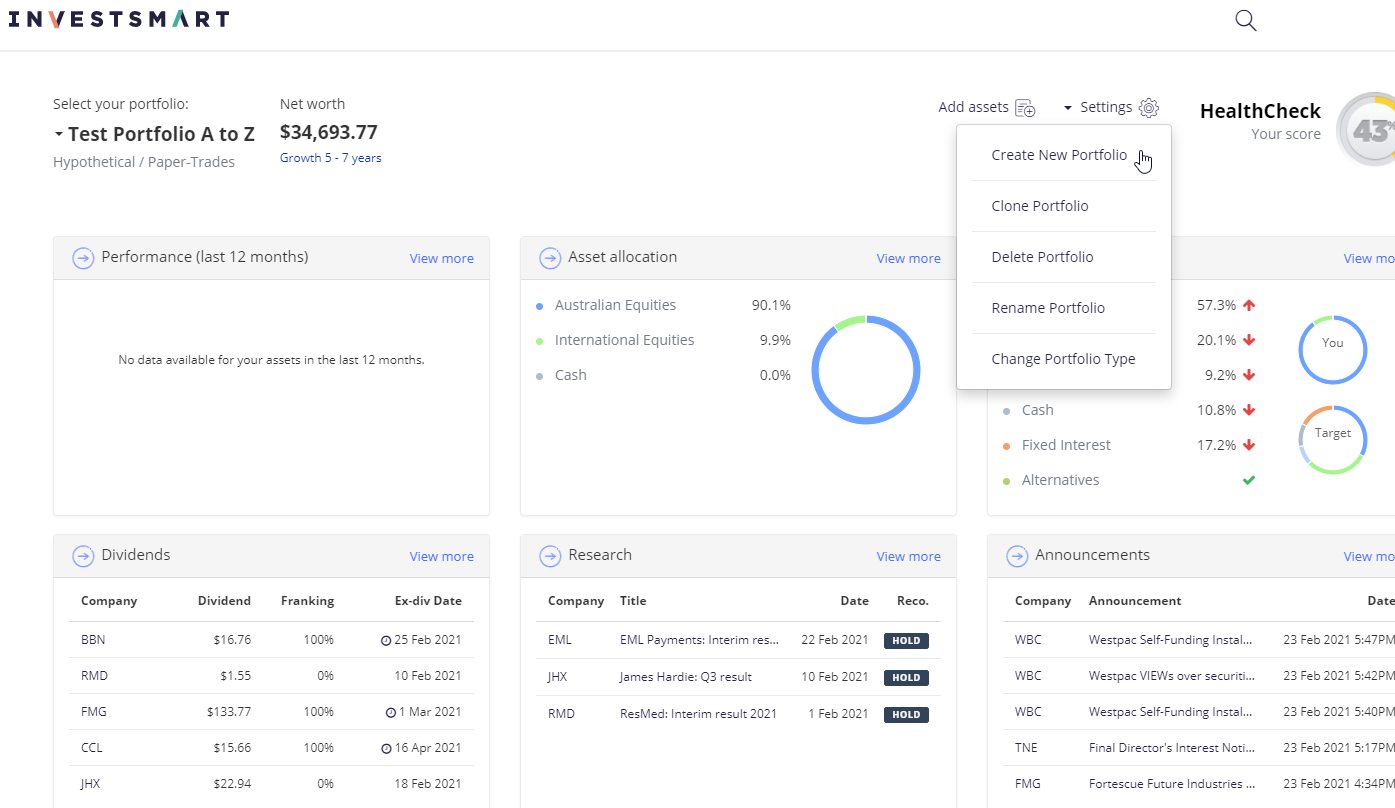

Then, as the screenshot below shows, click on the 'Setting' gear or cog, and choose New Portfolio.

What stock exchanges do you currently support?

We currently support the following Stock Exchanges which will allow you to automatically track your holdings:

| Market Code | Market Name | Update Frequency |

|---|---|---|

| AMEX | NYSE American | End of Day |

| ASX | Australian Stock Exchange | 20 minutes |

| EURONEXT | Euronext Amsterdam | End of Day |

| EURONEXT | Euronext Lisbon | End of Day |

| EURONEXT | Euronext Paris | End of Day |

| NASDAQ | NASDAQ Stock Market | End of Day |

| NYSE | New York Stock Exchange | End of Day |

| SSE | Shanghai Stock Exchange | End of Day |

| TSX | Toronto Stock Exchange | End of Day |

| TSXV | TSX Venture Exchange | End of Day |

Moving holdings to another portfolio

You can click the cog icon next to a holding, choose "move" from the drop-down menu, and then select the portfolio you wish to move it to.

Editing, deleting, updating assets in the Portfolio Manager

In the Portfolio Manager, how do you edit a portfolio, delete shares or change the value of a property?

Edit the Whole Portfolio

To edit a portfolio, click 'Settings' at the top right.

Here you can:

-

Clone the Portfolio

-

Delete the Portfolio

-

Rename the Portfolio

-

Change the Type of Portfolio (Investment/Superannuation/Hypothetical)

.png)

Delete Individual Shares or Holdings

To delete shares, go to Current Holdings > Shares, Options & ETFs.

Click the cog/gear at the beginning of the share you'd like to edit or delete.

(1).png)

Click View/Edit Transactions

Here you can change a number of pieces of information.

To delete, click the trash bin.

(1).png)

Changing the value of a property

Changing the value of a property is similar.

Go to Current Holdings > Property

Select the pen icon at the start of the line.

(1).png)